Introducing Allium's Orderflow Explorer: Tracing Every DEX Swap on Ethereum and Beyond

Discover how Allium's recently launched Orderflow Explorer, supported by a Uniswap Foundation grant, empowers onchain analysts and researchers to trace the full journey of decentralized exchange (DEX) swaps across multiple blockchains including Ethereum, Arbitrum, Base, and UniChain.

Introducing Allium's Orderflow Explorer: Tracing Every DEX Swap on Ethereum and Beyond

Decentralized exchanges (DEXs) have become a cornerstone of the decentralized finance (DeFi) ecosystem, enabling seamless peer-to-peer trading across multiple blockchains. But understanding the intricate swap flows and liquidity sources behind these trades has remained a complex and opaque challenge—until now.

Allium recently launched the Orderflow Explorer, a cutting-edge tool developed with support from a Uniswap Foundation grant. Designed specifically for onchain analysts, researchers, and DeFi enthusiasts, this Explorer enables you to trace the exact path of every DEX swap happening on Ethereum and its popular layer 2 solutions—Arbitrum, Base, and UniChain.

What Is the Orderflow Explorer?

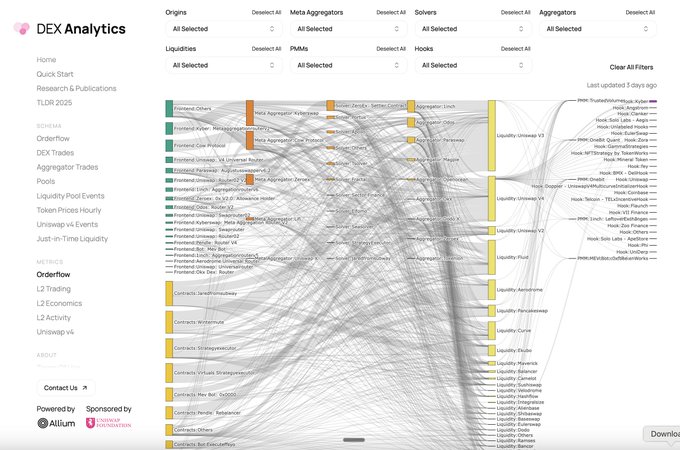

The Orderflow Explorer offers a transparent, detailed view into the lifecycle of a DEX swap, covering:

- Trade origins: Identify where each trade starts, whether from specific wallets, decentralized applications (dApps), or user interfaces.

- Routing paths: Understand how swaps are routed through aggregators, meta-aggregators, and intent-based systems optimizing for best execution.

- Liquidity sources: Pinpoint the pools, proactive market makers (PMMs), and hooks providing the underlying liquidity for the transactions.

How It Works: A Swap Example

Imagine a user initiating a swap via the Rabby wallet. The flow might look like this:

- User interaction: The user sends a swap request through Rabby.

- Routing: The request routes through the KyberSwap Aggregator.

- Aggregator nesting: KyberSwap in turn utilizes the 1inch aggregator to optimize orders.

- Liquidity sourcing: Finally, liquidity is pulled from Uniswap and Curve pools to fulfill the swap.

🔀 This multi-layered routing ensures optimal pricing and liquidity availability.

Building the Explorer: Methodology

To accurately map these complex flows, the Allium team:

- Classified protocols based on their execution role, ranking intent-based systems above meta-aggregators, aggregators, and then direct liquidity pools.

- Applied priority ranking to attribute components in each transaction—from origin and routing to solvers, swappers, and every liquidity pool touched in sequence.

This detailed classification enables the Explorer to reveal granular insights not only about where trades start and finish but also how execution layers interact.

🛠️ Learn more about the methodology here.

Explore the Tool

The Orderflow Explorer is publicly accessible at dexanalytics.org/metrics/orderf and provides an invaluable resource for anyone researching DeFi trading patterns, liquidity dynamics, or protocol design.

Allium’s Orderflow Explorer marks a significant step forward in blockchain analytics, empowering the community with transparency and sophisticated tooling for better understanding the decentralized markets that are shaping the future of finance.

Stay tuned to Allium’s channels for further updates and enhancements to this powerful analytic platform.