The Swift and Chainlink Partnership: Pioneering the Future of Global Finance

Explore how the strategic partnership between Swift and Chainlink is transforming the global financial landscape by integrating blockchain technology with traditional financial systems. Discover their joint milestones, innovative projects, and the pathway to a modernized, interoperable financial ecosystem.

The Swift and Chainlink Partnership: Pioneering the Future of Global Finance

In a milestone that signals a new era for global finance and blockchain technology, Swift announced at Sibos 2025 the launch of a blockchain-based ledger integrated within its infrastructure stack. This bold move highlights Swift’s commitment to innovating its ecosystem and embracing emerging technologies that hold the potential to revolutionize digital finance.

Chainlink, a trusted leader in oracle networks, has been a key partner throughout this journey. For over seven years, Chainlink and Swift have worked together to bridge traditional financial institutions with blockchain networks, enabling seamless connectivity using existing infrastructures and messaging standards.

Origins of Collaboration: From Concept to Concrete Solutions

The partnership’s roots date back to Sibos 2016, where Chainlink’s co-founder Sergey Nazarov introduced the concept of smart contracts automating post-trade processes for bond instruments compliant with ISO 20022 standards. This early innovation demonstrated how reliable real-world data could be securely delivered to blockchains through oracle infrastructure, enabling smart contracts to calculate bond coupon payments and trigger settlements via the Swift payment rails.

“That was maybe the first steps of this sort of love story between Swift and Chainlink, which continues today.”

— Jonathan Ehrenfeld Solé, Head of Strategy at Swift

This pioneering integration of trusted data oracles and established payment messaging laid the foundation for progressively sophisticated collaborations.

Accelerating Interoperability: Expanding Blockchain Access

By 2019, Chainlink had established itself as the industry-standard oracle platform within decentralized finance, while Swift actively explored blockchain applications focused on capital markets.

In 2021, Chainlink showcased how enterprises could link their backend systems to multiple blockchains, retaining existing workflows. Swift's participation in Chainlink’s SmartCon events underscored growing alignment and shared vision.

At SmartCon 2022, the teams announced development efforts around Chainlink's Cross-Chain Interoperability Protocol (CCIP). This technology aims to enable the movement of data and tokenized assets across diverse blockchains initiated via Swift's familiar infrastructure and messaging standards. Such an approach promises to streamline institutional access to the burgeoning array of blockchain networks.

Collaborations With Leading Financial Institutions

Building on these advancements, Swift and Chainlink collaborated with major financial players to pilot real-world applications demonstrating blockchain’s compatibility with existing financial infrastructures.

Cross-Chain Tokenized Asset Transfers

In 2023, a consortium of over a dozen institutions including Euroclear, Clearstream, Citi, and BNY Mellon successfully demonstrated cross-chain transfers of tokenized assets. This used a combination of Chainlink's smart contract and oracle technology alongside Swift's messaging networks, simulating settlements without the need to replace traditional backend systems.

Revolutionizing Corporate Actions Processing

In 2024, Swift, Chainlink, Euroclear, and eight prominent financial organizations launched an industry-wide initiative to enhance corporate actions data management using AI, oracle networks, and blockchain. This program focused on creating standardized onchain records from unstructured issuer disclosures, enabling seamless data access through existing Swift messaging protocols.

Bridging Tokenized Funds and Payment Systems

Also in 2024, Swift partnered with UBS Asset Management and Chainlink under Singapore’s Project Guardian to pilot tokenized fund subscriptions and redemptions seamlessly settled using the Swift network. Chainlink’s platform coordinated onchain minting and burning of fund tokens, while Swift transmitted fiat payment instructions, facilitating offchain cash settlements and bridging digital assets with existing payment infrastructures.

Enabling Banks to Embrace Blockchain via Established Standards

At Sibos 2024, Chainlink introduced a pre-production solution empowering banks to connect to blockchains using Swift’s messaging standards and infrastructure. This integration promises to preserve existing operational workflows and lower barriers to tokenized asset adoption at scale, fostering interoperability across financial ecosystems.

2025 and Beyond: Institutional-Grade Standards for Onchain Finance

Continuing their pioneering trajectory, Swift and Chainlink unveiled the Digital Transfer Agent (DTA) technical standard in collaboration with UBS, enabling direct management of tokenized fund workflows via Swift’s ISO 20022 messages. Leveraging Chainlink’s Runtime Environment (CRE) ensures smooth orchestration between onchain smart contracts and offchain messaging — expanding capabilities beyond cash settlement to stablecoin use cases.

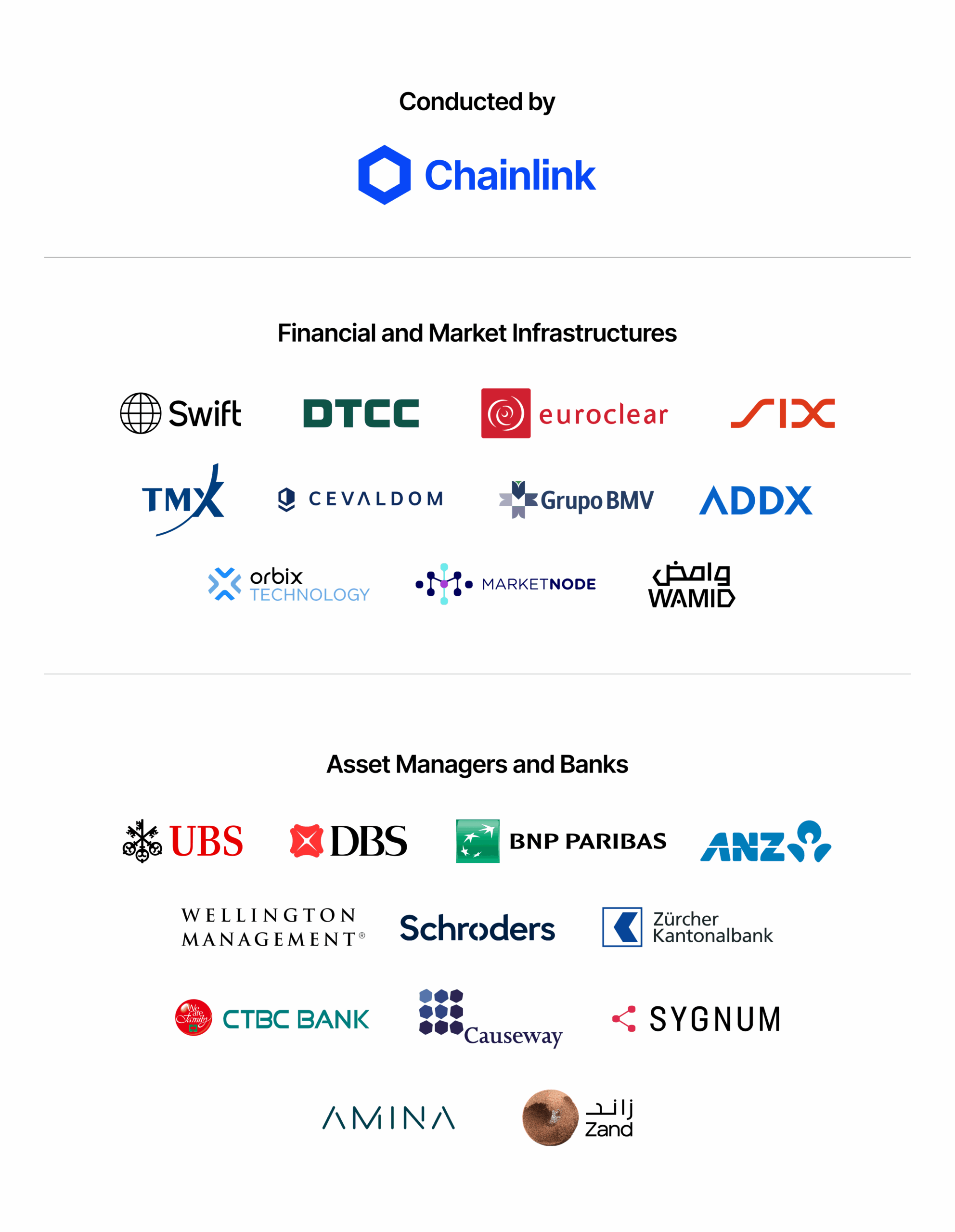

Further extending their industry impact, 24 leading financial institutions and market infrastructures including DTCC, Euroclear, SIX, UBS, and Wellington Management are advancing production-grade systems for corporate actions processing. By incorporating data attestor and contributor roles, they ensure trusted validation, achieving near-perfect accuracy of corporate event records accessible through Swift’s networks and distributed via blockchains.

Shaping the Next Chapter of Global Finance

The Swift and Chainlink partnership exemplifies how aligning blockchain innovation with existing market infrastructures and messaging standards can empower financial institutions worldwide. By enabling secure, scalable, and interoperable connections between traditional finance and blockchain ecosystems, they are laying the groundwork for a more efficient, transparent, and inclusive financial future.

As digital assets and onchain services become integral to finance, this collaboration will continue to be a beacon guiding institutions through transformation — proving that legacy systems and cutting-edge technology can evolve hand in hand.

We look forward to the continued evolution of this partnership, unlocking the full potential of tomorrow’s financial landscape.