Uniswap's First CCA Auction: A New Era of Fair and Transparent Token Distribution

Explore the groundbreaking first Uniswap CCA auction that raised $59 million with no sniping, bundling, or timing games. Learn how this novel auction format enables slow, fair price discovery and paves the way for robust secondary market liquidity.

Uniswap's First CCA Auction: A New Era of Fair and Transparent Token Distribution

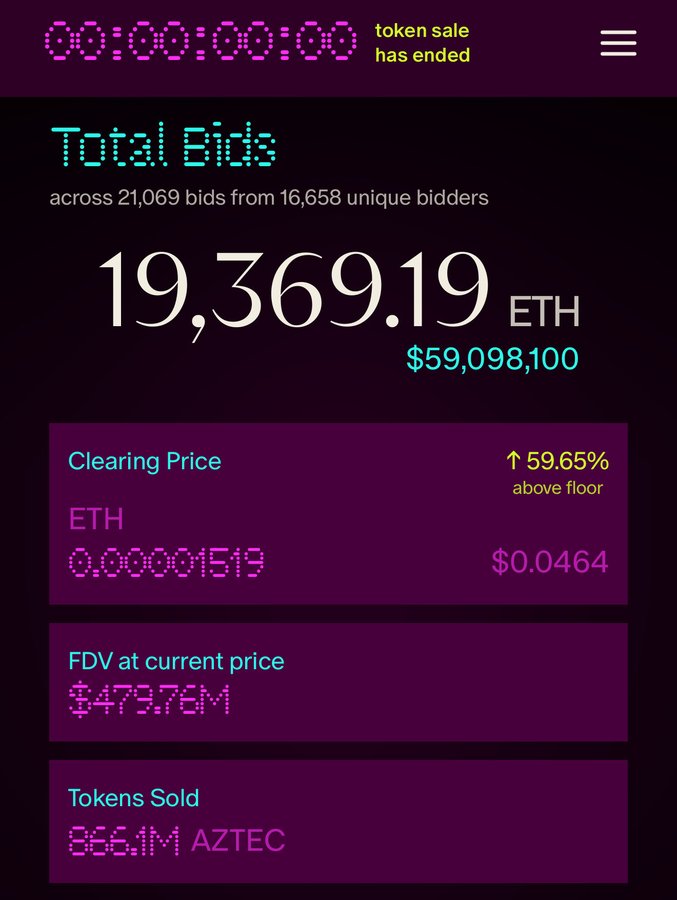

In a monumental milestone for decentralized finance (DeFi), Uniswap successfully conducted its first CCA (Colored Constant Auction) auction, raising an impressive $59 million in bids. This event has been hailed as a beautiful example of efficient and fair price discovery — without the typical pitfalls of traditional auctions such as sniping, bundling, or timing games.

What is a Uniswap CCA Auction?

The Colored Constant Auction (CCA) is a newly developed auction mechanism that aims to revolutionize how tokens are allocated in decentralized ecosystems. Unlike conventional auctions, which often encourage last-moment bidding strategies (also known as "sniping"), bundling bids, or exploiting timing to gain unfair advantages, the CCA prioritizes transparency, fairness, and price discovery.

How Does the CCA Work?

- Extended Bidding Period: Bidders have days to place their bids rather than minutes or hours. This timeframe enables a more measured decision-making process.

- No Sniping or Bundling: Since bids can be adjusted throughout the open bidding window, participants are discouraged from manipulative timing strategies.

- Dynamic Averaging: Rather than receiving an all-or-nothing allocation, bidders effectively average their price over the bidding period, mitigating risks of overpayment or adverse entry times.

This process culminates in a clearing price that reflects a consensus valuation— in the first Uniswap CCA, this was 59% above the floor price.

Highlights from the Auction

- Total bids reached $59 million, a significant vote of confidence from the community.

- Bidders who placed offers as high as a hypothetical $10 billion fully diluted valuation (FDV) would have only paid a dollar-cost averaged price between the floor and clearing price — protecting them from overpaying.

- The auction's structure eliminated common market inefficiencies, leading to true, slow, and fair price discovery.

Source: Hayden Adams on X

Beyond the Auction: Seeding Secondary Market Liquidity

An exciting aftermath of the auction involves utilizing a sizable portion of the raised proceeds and reserve tokens to seed a Uniswap v4 pool. This pool is poised to become the largest secondary market liquidity source for the token, ensuring:

- Continuous, seamless trading opportunities.

- Reduced price volatility due to deep liquidity.

- Enhanced confidence among token holders and traders.

This liquidity innovation opens up new meta-strategies for token management and market participation within the Uniswap ecosystem.

Why the CCA Matters for DeFi and Beyond

The successful execution of the first Uniswap CCA auction marks a pivotal step toward improving the fairness and efficiency of token distribution. By eliminating typical auction gaming behaviors, CCA facilitates:

- Greater accessibility for a wider array of participants.

- Enhanced price integrity reflecting true market demand.

- A scalable model for future decentralized projects seeking equitable token sales.

For those interested, more details and ongoing updates about this innovative auction format can be found at the official page: cca.uniswap.org.

Final Thoughts

Uniswap's first CCA auction demonstrates the power of thoughtful financial engineering within decentralized protocols. By prioritizing fairness and transparency, it sets a new standard that could redefine how token economies launch and sustain themselves in the rapidly evolving DeFi landscape.

Stay tuned as Uniswap continues to unlock new features and refine the mechanisms that empower decentralized communities worldwide.